|

|

| Classifieds I Travel I Exporters Listings I Importers I Trade Help I Business I Export ads I Publishing I RegisterBus I | |

Shipping Cars, Boats & Bikes from Thailand on a Temporary Import Basis

KPS International Trade (Thailand) Co,.Ltd. &

SE Asia Trading Shipping

Tel : +61-435336560

Line ID : KPS-Nisarat

Email : bangkok@pobox.com for all your inquiries

ADDRESS:

77/74-77/75 The Money Me

Moo.1 Khlong Sam

Khlong Luang,Pathum Thani 12120

Tel : 02-0031674

Fax : 02-0031675

Mobile number 086-5752995 or email us for info

|

ASIA TRADING SHIPPING -- ASIA TRADING POST CO LTD Thailand shipping and freight movers worldwide. We are foreign UK / NZ / Thai MANAGEMENT. We send anything from personal to cars, trucks, roll on roll off, FCL 20-40ft high cube containers anywhere dealing with foreign clients worldwide: clothes, garments to machinery to cars-- logistics services (Door to Door/ Port to Port) We process all the paperwork- Air freight services- Sea freight services--same day quotes- Depots in Pratunam, Rama4 & Chiangmai with own packing, fumigation inhouse, storage. EXPORT ONLY: email us export@pobox.com

|

|

Complete Import and Export services --- the world wide freight forwarder . Due to many requests we now offer outside exporters, companies and individuals who want to buy products in Asia our complete export buyer agent service. What we do for you: Packing, Shipping, Moving, Storage, By Land, Sea Freight, Air Freight & ultra Low Rates |

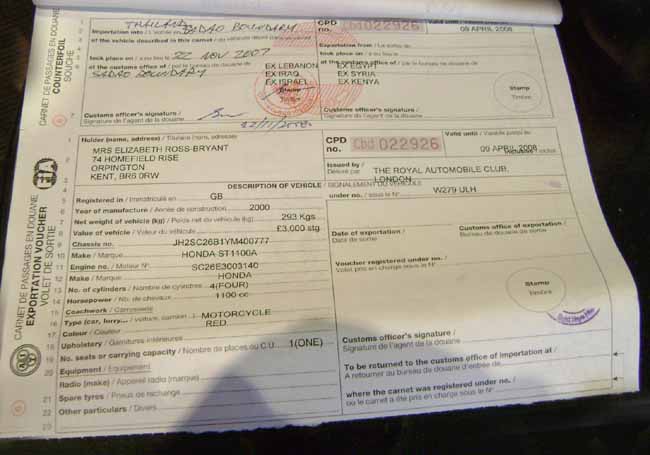

A temporary import of personal vehicles for a short visit e.g. a motor vehicle, motorcycle, yacht, sports boat, or fishing vessel, etc. into Thailand by owners shall be grant tax/duty relief provided that they are to be re-exported within 1-2 months but not exceeding six months. Any persons intending to temporarily import personal vehicles e.g. a motor vehicle, motorcycle, yacht, sports boat, or fishing vessel, etc. have to closely observe the following Customs regulations and conditions:

PATTAYA FREIGHT, AIR & SEA SHIPPING,TRANSPORT TO PACKING SERVICES CHECK OUT

We now export the Toyota Vigo model pickups.

Documentation: The minimum documents required for a temporary import of personal vehicle consist of:

|

Clearance Procedures for a Temporary Import of Personal Vehicles

|

||||||||||||

|

||||||||||||

|

An Importer Fails to Re-Export the Vehicle within the Time-Limit

|

Contact For additional information, any interested persons may contact the Customs Information Service Center at TEL 1164

We are happy to quote you customs clearance both import and export side.

1. Customs Clearance for import side

1.Importation document Handling THB 3,000.00/Shipment

2.Deposit guarantee Handling THB 5,000.00/Shipment

3.Customs formality THB 5,000.00/Shipment

4.Shipping charge THB 4,500.00/Shipment 5.Handling charge THB 2,500.00/Shipment 6.Custom surcharge THB 200.00/Company THB 270.00/Personal As per customs receipt 7.Loading & Labor charge THB 500.00/Men 8.Free duty but paid 7% for tax As Actual Customs receipt 9.Storage Charge As Actual Customs receipt 10.D/O Fee As Actaul Carrier line receipt 11.EDI/E-paperless Fee As per receipt

2. Customs Clearance for export side

1. Freight charge To be advise

2.Exportation document Handling THB 3,000.00/Shipment

3.Customs formality THB 5,000.00/Shipment

4.Shipping charge THB 4,500.00/Shipment 5.Handling charge THB 2,500.00/Shipment 6.Custom surcharge THB 200.00/Company THB 270.00/Personal As per customs receipt 7.Loading & Labor charge THB 500.00/Men 8.EDI/E-paperless Fee As per receipt

Above rate exclusive vat 7% and Transportation charge (If Any) |

SEE [ TEMPORARY IMPORTING VEHICLES ] INTO THAILAND RULES. For returning Thais wanting to bring cars into Thailand please send full details of car: year, make, model,cc rating, when purchased overseas, whose the owner and specs & picture. We can clear cars for you once we know these facts.

WE

EXPORT ALL MOTOR VEHICLES FROM THAILAND FOR CUSTOMERS EX BANGKOK. [ Export

pickups ]

|

FOR FREE CARGO QUOTATION TO ANY COUNTRY PLEASE EMAIL US. We export from Chiangmai & Bangkok Thailand. [ Shipping form ] |

[ SEA FREIGHT HELP ] [ SHIPPING & CO TO AUSTRALIA ] [ BILL OF LADING SHIPPING DOC ] [ CERT OF ORIGIN ] [ AIR FREIGHT FLOWERS,FISH ETC ] [ SHIPPING WORLD PORTS OF ENTRY ] [ INTERNAL TRANSPORT ] [ SHIPPING MOTORCYCLES ] [ BIKES TO AUSTRALIA PACKING ] [ PRATUNAM MARKET GARMENT HOTELS ] [ GARMENT BUYING HELP ] [ GO TO SHIPPING & AGENCY FORM ] [ TEMPORARY IMPORTING ] [ TEMPORARY SHIPPING USING A "CARNET" ] [ SEA FREIGHT RATES ] [ TRACK SEAFREIGHT ] [ AIRFREIGHT AIRLINES ] [ OTHER FREIGHT COMPANIES ] [ TARRIFS ] [ SHIPPING PERSONAL GOODS ] [ CERT OF ORIGIN ] [ SOURCING GOODS FOR YOU ][ UK CLEARING AGENT ] [ STORAGE IN BANGKOK ] [ SHIPPING TO USA ] [ IMPORTING CARS ] [ CONTAINERS FOR SALE ] [ SHIPPING TERMS & ABREVS ] [ OUR YANNAWA BANGKOK STORAGE & LOADING ] [ 40ft used Containers for sale ] [ UNACCOMPANIED BAGGAGE ] [ SENDING UNDER 45KGS AIR FREIGHT ] [ SHIPPING TO WELLINGTON NZ -STOLEN GOODS ]

|

N.B. Complete law services via our NEW Thai Lawyer partner . (re: Alien Business Law: NEC Announcement 281 Cat A prohibited to foreigners). However under the terms of our Company License Asia Trading Post (Co Ltd) provide : 1. Cat 34 lawyer services &2. Cat 35.consultancy services. |

COPYRIGHT: No parts or parts of this website may be copied, printed or circulated for publication in any form or part of without the express written permission of Asia Trading Post Please also note all Thailand affected pages which include eg. law, immigration, visas can not be used unless written permission is obtained from Asia Trading Post by way of contract. All infringements will be an infringement of privacy and our company will act accordingly. See FAQs